Originally Posted by

Natural Lefty

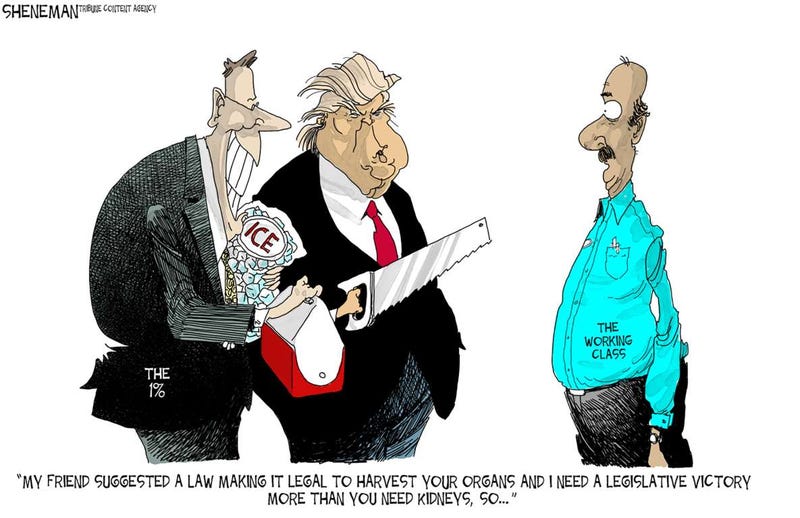

And the only reason the Republicans are doing this tax bill, apparently, is to further enrich their wealthy benefactors so that they will get more campaign donations from them. Hopefully, this will all backfire on the Republicans. According to FiveThirtyEight, this is the only tax bill in history which has a net disapproval rating. In fact, it is more unpopular than previous tax increases were. People are starting to see through their agenda.

Their only justification for it, government budget-wise, is trickle down economics, which depends on the Laffer Curve, developed by Arthur Laffer. (What a Laffer.) This curve says that lowering taxes can stimulate the economy so much that it increases government revenue. However, not only do we know that money transfers to the wealthy increase wealth and power disparities, and fail to trickle down to the general public, but also, in actual studies, the optimum effective tax rate under the Laffer Curve is around 70%, maybe even a little higher. The effective tax rate in the United States, prior to this bill which lowers it still further, was 29.8%, including all taxes (local, state, federal and fees), which obviously is FAR lower already that the Laffer Curve evidence would advocate. But Republicans have never seen a tax that they like, and continue to play tax rate limbo, trying to see how low they can go before they whole system collapses. I suspect we are about to find out, as even Goldman Sachs is warning that the low tax rates in the U.S. are threatening to cause national debt levels to reach unsustainable levels.

Further, the Congressional Budget office did an analysis in 2006, I think it was, which found that a 10% decrease in the tax rate would result in transfers of wealth to the rich, ultimately to be paid for by other Americans. Plus, to top it off, the best job growth rates are found when the top tier tax rates are between 85% -90%. In short, the entire thing is a rich person's scam on the rest of us.

Reply With Quote

Reply With Quote